What is Mutual Fund?

A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers who allocate the fund's assets and attempt to produce capital gains or income for the fund's investors. A mutual fund's portfolio is structured and maintained to match the investment objectives stated in its prospectus.

Mutual funds give small or individual investors access to professionally managed portfolios of equities, bonds, and other securities. Each shareholder, therefore, participates proportionally in the gains or losses of the fund. Mutual funds invest in a vast number of securities, and performance is usually tracked as the change in the total market cap of the fund—derived by the aggregating performance of the underlying investments.

Understanding Mutual Funds

Mutual funds pool money from the investing public and use that money to buy other securities, usually stocks and bonds. The value of the mutual fund company depends on the performance of the securities it decides to buy. So, when you buy a unit or share of a mutual fund, you are buying the performance of its portfolio or, more precisely, a part of the portfolio's value. Investing in a share of a mutual fund is different from investing in shares of stock. Unlike stock, mutual fund shares do not give its holders any voting rights. A share of a mutual fund represents investments in many different stocks (or other securities) instead of just one holding.

That's why the price of a mutual fund share is referred to as the net asset value (NAV) per share, sometimes expressed as NAVPS. A fund's NAV is derived by dividing the total value of the securities in the portfolio by the total amount of outstanding shares. Outstanding shares are those held by all shareholders, institutional investors, and company officers or insiders. Mutual fund shares can typically be purchased or redeemed as needed at the fund's current NAV, which—unlike a stock price—doesn't fluctuate during market hours, but it is settled at the end of each trading day. Ergo, the price of a mutual fund is also updated when the NAVPS is settled.

The average mutual fund holds over a hundred different securities, which means mutual fund shareholders gain important diversification at a low price. Consider an investor who buys only Google stock before the company has a bad quarter. He stands to lose a great deal of value because all of his dollars are tied to one company. On the other hand, a different investor may buy shares of a mutual fund that happens to own some Google stock. When Google has a bad quarter, she loses significantly less because Google is just a small part of the fund's portfolio.

Key Takeaways

- A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities.

- Mutual funds give small or individual investors access to diversified, professionally managed portfolios at a low price.

- Mutual funds are divided into several kinds of categories, representing the kinds of securities they invest in, their investment objectives, and the type of returns they seek.

- Mutual funds charge annual fees (called expense ratios) and, in some cases, commissions, which can affect their overall returns.

- The overwhelming majority of money in employer-sponsored retirement plans goes into mutual funds.

How Mutual Funds Work?

A mutual fund is both an investment and an actual company. This dual nature may seem strange, but it is no different from how a share of AAPL is a representation of Apple Inc. When an investor buys Apple stock, he is buying partial ownership of the company and its assets. Similarly, a mutual fund investor is buying partial ownership of the mutual fund company and its assets. The difference is that Apple is in the business of making innovative devices and tablets, while a mutual fund company is in the business of making investments.

Types of Mutual Fund

Mutual funds are divided into several kinds of categories, representing the kinds of securities they have targeted for their portfolios and the type of returns they seek. There is a fund for nearly every type of investor or investment approach. Other common types of mutual funds include money market funds, sector funds, alternative funds, smart-beta funds, target-date funds, and even funds of funds, or mutual funds that buy shares of other mutual funds.

Classes of Mutual Fund Shares

Mutual fund shares come in several classes. Their differences reflect the number and size of fees associated with them.

Currently, most individual investors purchase mutual funds with A shares through a broker. This purchase includes a front-end load of up to 5% or more, plus management fees and ongoing fees for distributions, also known as 12b-1 fees. To top it off, loads on A shares vary quite a bit, which can create a conflict of interest. Financial advisors selling these products may encourage clients to buy higher-load offerings to bring in bigger commissions for themselves. With front-end funds, the investor pays these expenses as they buy into the fund.

To remedy these problems and meet fiduciary-rule standards, investment companies have started designating new share classes, including "level load" C shares, which generally don't have a front-end load but carry a 1% 12b-1 annual distribution fee.

Funds that charge management and other fees when an investor sell their holdings are classified as Class B shares.

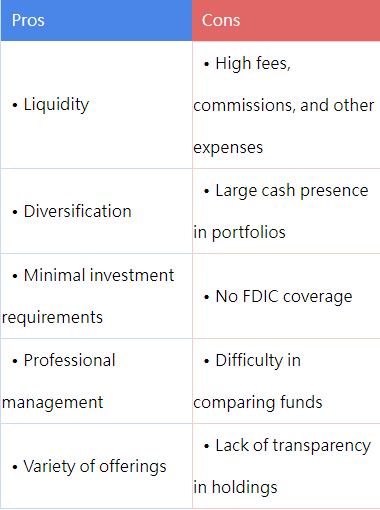

Disadvantages of Mutual Funds

Liquidity, diversification, and professional management all make mutual funds attractive options for younger, novice, and other individual investors who don't want to actively manage their money.

Active Fund Management

Many investors debate whether or not the professionals are any better than you or I at picking stocks. Management is by no means infallible, and even if the fund loses money, the manager still gets paid. Actively managed funds incur higher fees, but increasingly passive index funds have gained popularity. These funds track an index such as the S&P 500 and are much less costly to hold. Actively managed funds over several time periods have failed to outperform their benchmark indices, especially after accounting for taxes and fees.